Adaptive Algo

The Adaptive algo order type combines IB's smart routing capabilities with user-defined priority settings in an effort to achieve a fast fill at the best all-in price. It can be used as either a market or limit order.

The Adaptive Algo is designed to ensure that both market and aggressive limit orders trade between the bid and ask prices. On average, using the Adaptive algo leads to better fill prices than using regular market or limit orders. This algo order type is most useful to an investor when the spread is wide, but can also be helpful when the spread is only one tick.

Adaptive Market Orders

While a basic market buy order would go straight to the ask price, an Adaptive market order starts within the bid/ask spread and incrementally checks prices to the ask to fill the specified quantity. The time taken to scan for better prices is determined by the priority setting you select. The 'urgent' setting scans briefly, while the 'patient' scan works more slowly and has a higher chance of achieving a better overall fill price for your order. There is a risk, especially with the 'patient' priority, that during the scanning time the price of the security may move away from the original price.

Adaptive Limit Orders

For Adaptive limit orders that are set to fill between the bid and ask prices, the algo will attempt to execute at the most favorable price in the same way as described above, and will only fill at the limit price or better.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Stocks |  |

US Products |  |

Smart |  |

Attribute |  |

| Options |  |

Non-US Products |  |

Directed |  |

Order Type |  |

| Futures |  |

IB Algo |  |

Time in Force |  |

||

| CFDs |  |

IB Algo |  |

||||

| Open Users' Guide | |||||||

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

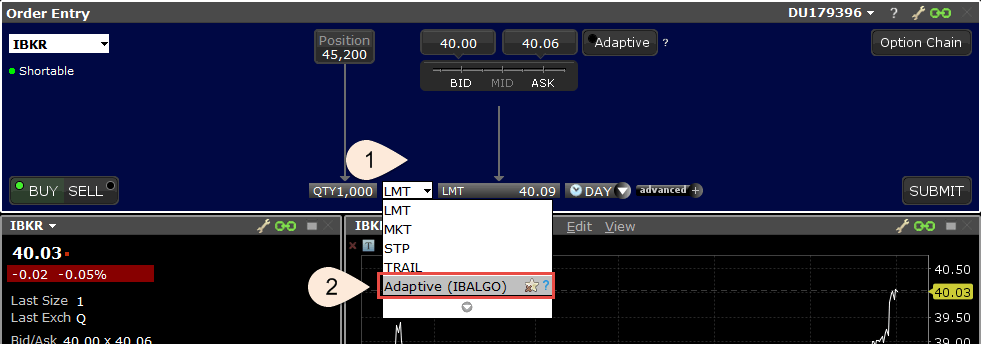

To Create an Adaptive Algo in Mosaic

Set up the order in the Mosaic Order Entry panel. Create a buy or sell order:

Step 1 – Enter quantity to trade

Step 2 - From the LMT type field select IBALGO and then select Adaptive.

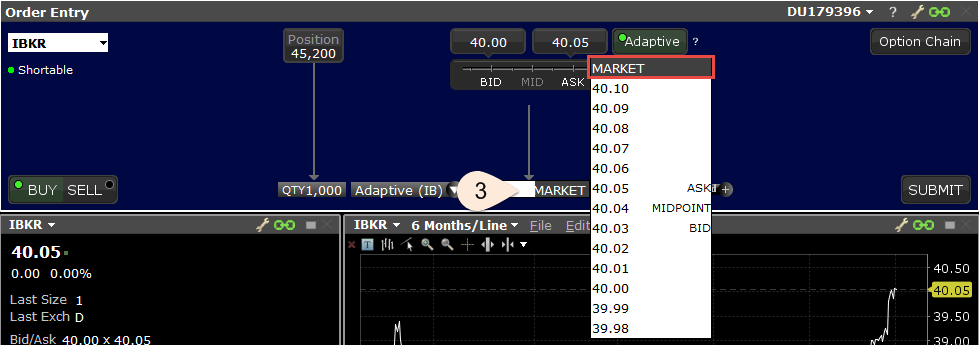

Step 3 – In the price field, modify the limit price (to use a limit order), or use the price wand to select the MARKET price (to use a market order).

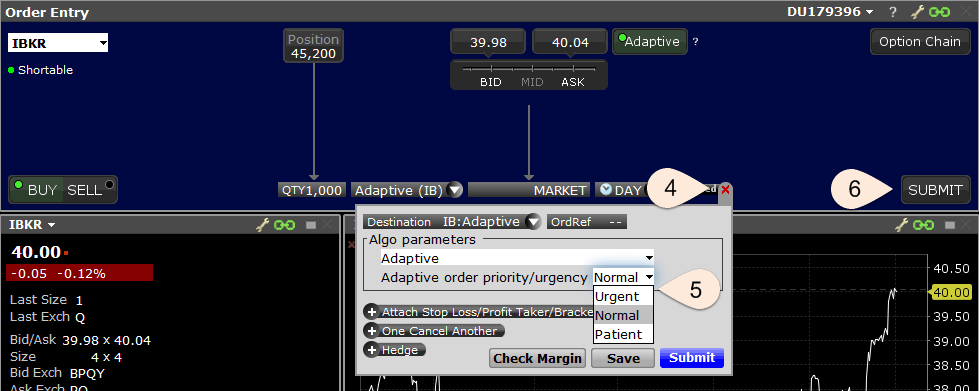

Step 4 – In order to specify the urgency, open the Advanced panel by clicking on the red 'x' button.

Step 5 – From the drop down menu choose from the selection of priority/urgency parameters.

Step 6 – Click Submit to send the order.

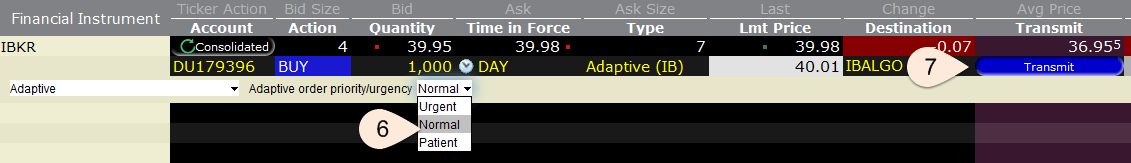

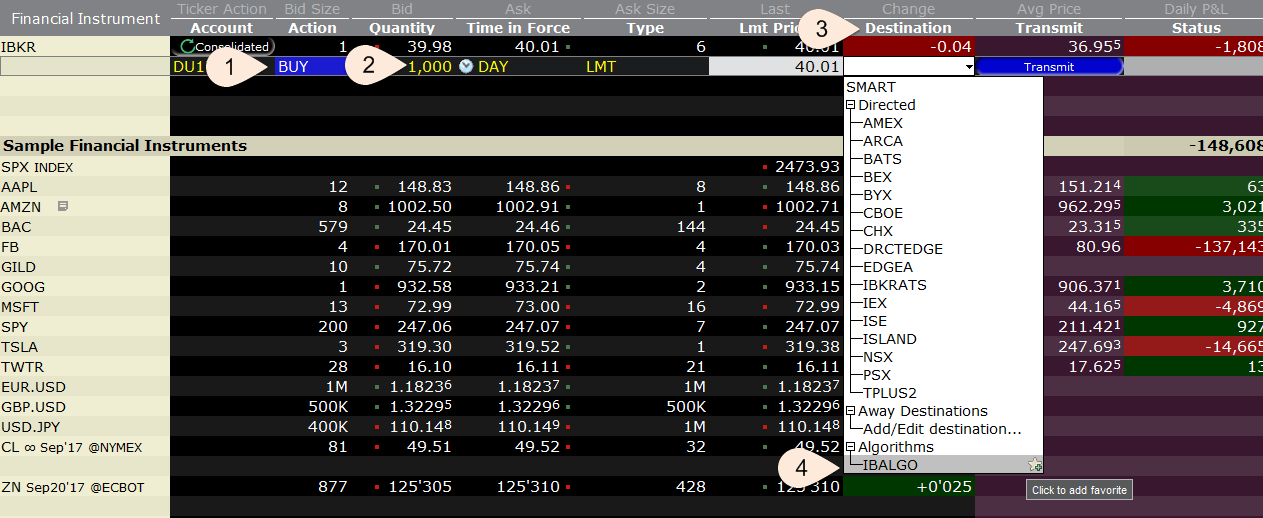

To Create an Adaptive Algo in Classic TWS

Step 1 – For an order to purchase, click on the Ask price of the security.

Step 2 – In the Quantity field, input the number of shares to be bought.

Step 3 – In the order row, locate the Destination column and

Step 4 – Click on SMART to reveal a list of possible venues – select IBALGO, which creates a variety of algo order types.

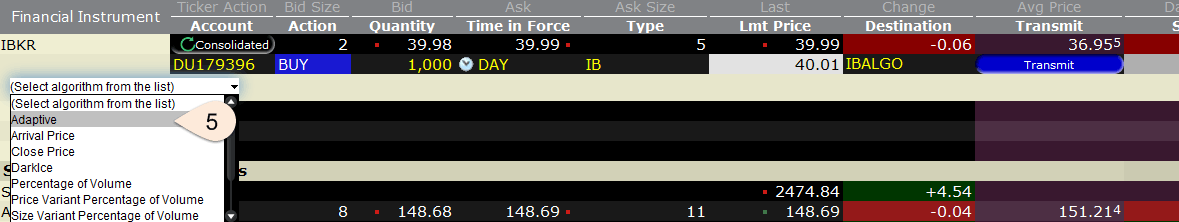

Step 5 – From the dropdown menu, select Adaptive.

Step 6 – Select from the list of choices under the priority/urgency dropdown menu.

Step 7 – Click Submit to send the order.